Security Tips

In this digital age, protecting your financial wellbeing is of paramount importance, and we’re here to empower you with the knowledge and best practices to ensure the security of your accounts.

Explore our tips below to stay informed and fortify your banking experience with us.

Your peace of mind is our commitment.

Stay Informed!

Types of Internet Fraud and Security

Phishing

Phishing

“Phishing” is a form of internet piracy and one of the fastest growing types of fraud. It typically involves the use of a bogus e-mail message or pop-up window, along with a company’s name, graphics, or logo, to deceive recipients into disclosing personal and financial information, such as a password or social security number.

Often, victims of phishing attacks are asked to follow links in emails that redirect them to phony websites, some of which mimic the look and feel of a legitimate website.

For more information on phishing, view this infographic.

Other Types of Online Banking Attacks

Fraudsters are increasingly utilizing sophisticated internet piracy techniques, in addition to more traditional methods such as phishing, to steal funds and/or personal financial information.

These techniques generally involve the use of malware, or malicious software programs, installed on a customer’s local computer often without that customer’s knowledge. Keyloggers are malware that record keystrokes and can be used to steal information such as logon IDs and passwords. Some malware allow fraudsters to insert themselves between a customer and a financial institution and to hijack their online session. These sophisticated attacks can lead to improper transfers of funds from a customer’s account.

Commercial Banking Customers

The First Bank of Greenwich provides enhanced authentication procedures for certain high-risk commercial banking activities. Nevertheless, commercial banking customers are advised to conduct periodic, internal risk assessments relative to the online banking system at The First Bank of Greenwich.

How to Avoid Attacks

- Never respond to an unsolicited e-mail asking for personal or financial information or provide personal or financial information in response to an unsolicited request.

- Never follow links in unsolicited e-mails.

- Never provide personal or financial information after being redirected to a new website.

- Make sure anti-virus or anti-malware software is installed and up to date on any computer used in online banking and any computer that may store or transfer personal or financial information.

- Monitor your account regularly for any suspicious or potentially fraudulent activity.

- When in doubt, contact The First Bank of Greenwich to confirm the legitimacy of any communication.

If You Believe You May Be a Victim

- Immediately contact The First Bank of Greenwich.

- If you believe your personal or financial information has been compromised, contact the three major consumer credit reporting agencies – Experian, Equifax and TransUnion – and request that the agencies place a fraud alert on your account.

- Carefully monitor account activity and review account statements for suspicious items after the attack.

- Report the incident to the Federal Trade Commission (FTC) at 1-877-382-4357 and with the FBI’s Internet Crime Complaint Center.

- Consider contacting your local police department to file a criminal report.

Contact Information for Credit Reporting Agencies

- Equifax: 1-800-525-6285

- Experian: 1-888-397-3742

- TransUnion: 1-800-680-7289

Scam Alert – Telephone Phishing

The First Bank of Greenwich Bank customers as well as several other Connecticut Banks are currently experiencing a telephone phishing scam. Calls are being placed to consumers from people claiming to be bank employees asking for personal information. The First Bank of Greenwich will never request your personal private information or account information unless you initiate the request via one of our known methods of communication.

If You Believe You May Be a Victim

- Immediately contact The First Bank of Greenwich.

- If you believe your personal or financial information has been compromised, contact the three major consumer credit reporting agencies – Experian, Equifax and TransUnion – and request that the agencies place a fraud alert on your account.

- Carefully monitor account activity and review account statements for suspicious items after the attack.

- Report the incident to the Federal Trade Commission (FTC) at 1-877-382-4357 and with the FBI’s Internet Crime Complaint Center.

- Consider contacting your local police department to file a criminal report.

Contact Information for Credit Reporting Agencies

- Equifax: 1-800-525-6285

- Experian: 1-888-397-3742

- TransUnion: 1-800-680-7289

A Bank Customer’s Guide to Cybersecurity

FDIC Consumer News: A Bank Customer’s Guide to Cybersecurity – Special Edition: Winter 2016

Scam Alert - Pig Butchering

The pig butchering scam is a long-term fraud that combines investment schemes, romance scams, and cryptocurrency fraud. This scam originated in Southeast Asia, and the name originates from the Chinese phrase “Shaz HQ Pan,” meaning pig butchering. The analogy comes from gaining trust in the victim — fattening up the pig — then stealing cryptocurrency or money — the butchering.

What is Pig Butchering?

Pig butchering is a crypto scam that uses catfishing to gain the victim’s trust and convince them to join a financial investment scheme.

How does it happen?

- The scammer initiates contact with the potential victim through social media. dating apps. or text messages. It may also start as a text from a wrong number or a direct message on social media.

- The scammer then gains the trust of the victim over time. and eventually encourages the victim to invest in cryptocurrency trading.

- The scammer then tells the victim to download an app or visit a website to make cryptocurrency trades. Sometimes, they offer to trade alongside the victim. However, this platform is controlled by scammers.

- The victim is encouraged to add more money to the account. However, if the victim wants to withdraw funds, the account says the victim needs to pay fees or taxes to access it. After the victim realizes the platform is fake. the transactions disappear on the blockchain, never to be seen again.

Visit the FBl’s ic3.gov site to file a complaint and stay informed!

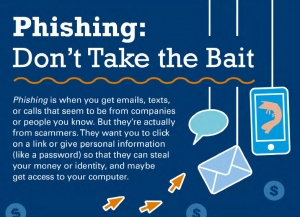

Phishing: Don't Take The Bait

Welcome to our comprehensive guide on phishing awareness!

As part of our commitment to safeguarding your financial security, we’d like to share with you this infographic on phishing scams provided by the American Bankers Association. This visual aid offers tips and strategies to recognize and thwart phishing attempts; ensuring your personal and financial information remains protected. Explore the document to familiarize yourself with common phishing tactics, learn how to identify suspicious emails, and discover proactive measures to mitigate the risk of falling victim to cybercrime. Arm yourself with knowledge and stay one step ahead of malicious actors targeting unsuspecting individuals.

Download the infographic today and empower yourself with the tools to navigate the digital landscape securely.

Elder Fraud Awareness

Each year, millions of elderly Americans fall victim to some type of financial fraud or confidence scheme. Criminals will gain their targets’ trust and may communicate with them directly online, over the phone, and/or through the mail; or indirectly through the TV and radio. Annual losses among the older population are more than $3 billion dollars and continues to rise. Unfortunately, the older population is targeted due to their increased assets, good credit standing and the fact that they tend to be trusting and polite.

Elder Abuse continues to increase each year. If you believe you or someone you know may have been a victim of elder fraud, contact your local FBI field office or submit a tip online. You can also file a complaint with the FBI’s Internet Crime Complaint Center at ic3.gov.

And click here to download our guide to common elder abuse scams and tips to help you and your loved ones in the fight against fraud.

Phishing Red Flags & A Safe Check Overview from the American Bankers Association

Every day, thousands of people fall victim to fraudulent calls, emails and texts from scammers pretending to be from their bank. The American Bankers Association wants to change that.

That’s why in 2020 they launched a major consumer protection initiative designed to educate consumers about the persistent threat of phishing scams and empower them to identify illegitimate bank communications, #BanksNeverAskThat. The ABA introduced a companion campaign, #PracticeSafeChecks, in 2024 to address the resurgence of check fraud and educate consumers on safe check practices.

With the help of more than 2,000 banks from across the nation, they’re turning the tables on the bad guys by empowering consumers with the tools they need to spot bogus bank communications and stay a step away from fraud. View a PDF on spotting phishing red flags from BanksNeverAskThat.com here and a safe check overview from PracticeSafeChecks.com here.

Don't Fall For It!

Scammers are becoming increasingly sophisticated, but sometimes, a simple defense is your best shield. They employ various tactics, including technology, impersonation, and couriers, all aimed at swindling you out of your hard-earned savings. Despite their high tech methods, you can safeguard your accounts by following the simple guidelines outline here.

Locations & Hours

Main Branch

Cos Cob

444 East Putnam Ave.

Cos Cob, CT 06807

P (203) 629-8400

F (203) 629-8409

ATM

Drive-Up

Walk-Up Window

Summer Street Branch

Stamford

Westchester Branch

Port Chester

500 Westchester Ave.

Port Chester, NY 10573

P (914) 908-5444

F (914) 908-2424

ATM

Drive-Up

Walk-Up Window

Hours of Operation

Monday–Wednesday

8:30 am - 4:00 pm

Thursday

8:30 am - 6:00 pm

Friday

8:30 am - 4:00 pm

Saturday

9:00 am - 12:00 pm

Sunday

Closed